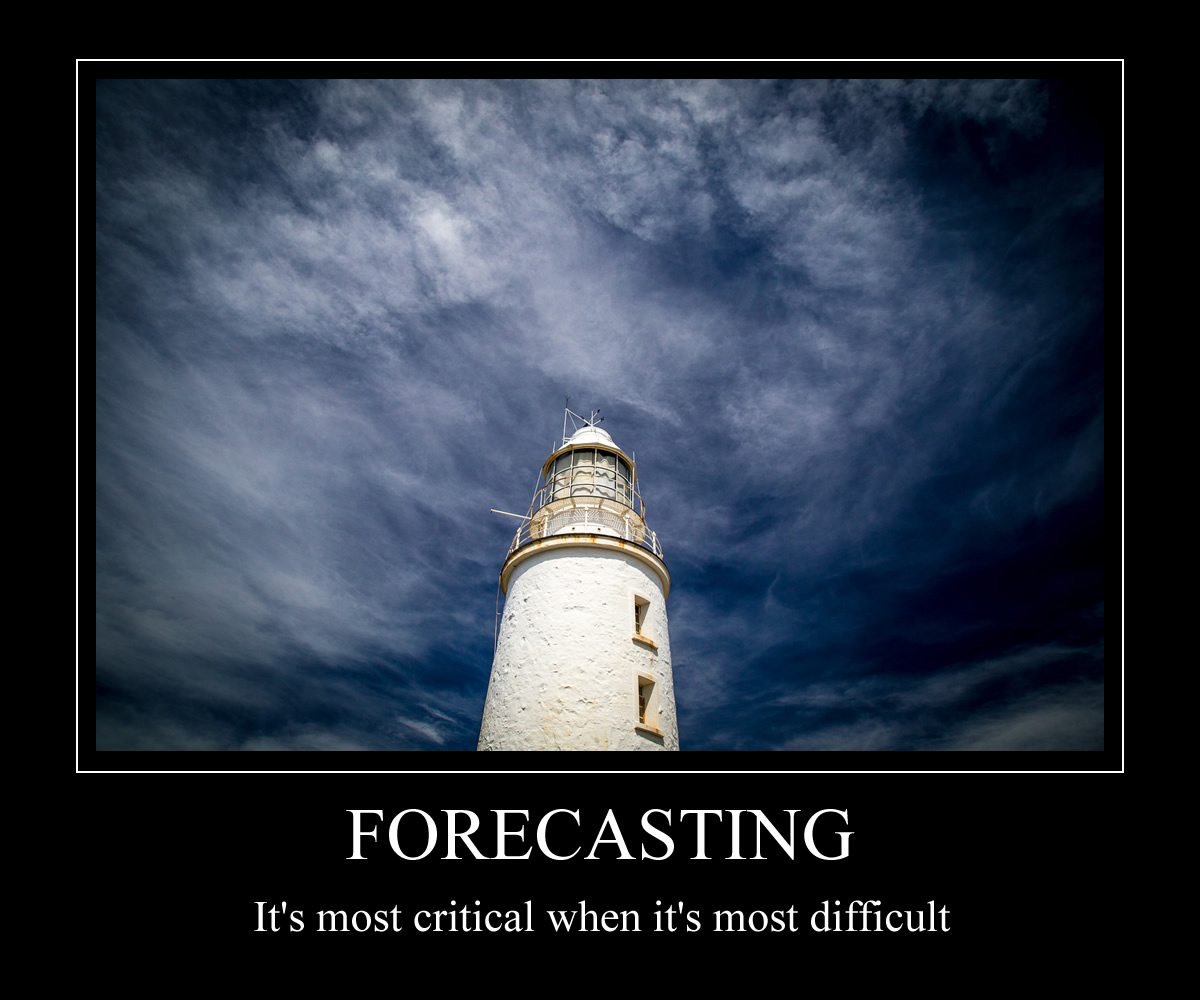

Market volatility, depressed prices and slow growth are major factors affecting virtually all companies.

For everyone, the focus on maintaining and improving their financial position is intense and this means planning, budgeting and forecasting has never been more critical to success.

So here are the seven forecasting habits of highly successful companies:

1. Forecast in two directions

Top down forecasting – where the most senior management define the objectives of the company and then all levels below build their planning and forecasting off this vision – has its flaws.

Yes, it can be the best way to ensure your companies high-level goals are embedded within your plan. But, as anyone who has worked under this regime in a big company will testify, it also runs the risk of weak organisational buy-in and a lack of grass roots knowledge – making forecasting accuracy less feasible.

A bottom up approach to forecasting encourages organisational buy-in and improves feasibility – as each department, function or division contributes to creating the forecast. But the major risk is that a grassroots generated forecast is not the best fit to help the company achieve its wider goals.

The most successful companies combine a top down and bottom up approach.

While more complicated to manage, it means you get the benefits of both methods without the common flaws. When supported with well-defined processes and good levels of automation, this approach is effective in linking the performance of all levels of the organisation to the wider company vision. And this promotes a level of confidence and buy-in that makes that vision more achievable.

2. Get your financial house in order

No organisation sets out to have financial planning and forecasting delays.

But … it happens. Regularly!

Failing to get forecasts done on a timely basis is usually a sign of more concerning lapses of financial control in the organisation.

In the most successful companies, forecasts are completed at least quarterly.

This one key action is a strong indicator of the likely success of an organisation’s overall financial planning processes.

3. Hold people accountable for forecast accuracy

That’s pretty obvious, right? Of course you monitor performance against forecasts and hold people accountable. It’s likely your management will have to explain why targets were not hit and goals not achieved.

But is that enough?

Is that enough of an incentive to gain a competitive advantage in your control of inputs and outputs?

For the best performing companies, the answer is no.

They know that there is a greater chance of improved financial planning performance when a manager’s personal interest is tied to forecasting accuracy.

The facts are simple: when bonuses and even job security are linked to accurate forecasts, managers are more likely to make their forecasts as accurate as possible.

These firms achieve significantly better financial planning outcomes as a result. In fact, the best in class companies are five times more likely to link compensation to goals, targets and forecasting accuracy.

Keep in mind however, that you can only hold people accountable for things they have control over e.g. no one is responsible for movements in commodity prices.

4. Keep your forecast agile

With the volatile economic conditions that prevail, agility in financial planning is key to decreasing risk and grabbing opportunities.

External and internal factors can greatly alter your ability to attain the goals you have set. So it’s hardly a surprise that having the ability to re-think and then re-forecast as market conditions change is a tremendous advantage.

By keeping agile and reacting to changing conditions, you ensure your forecasts do not become unrealistic over time.

Successful companies perform scenario modelling, including the capability to conduct “what if” scenario and change analysis.

This type of analysis makes your financial plans more informed because they’ve taken into account and anticipated the effect of a range of possible events.

Put simply, this puts you in the fortunate position of being able to consider alternative scenarios and having the ability to change forecasts, plans and forecasts mid-stream.

5. Improve the quality of your data

There are myriad ways to improve the quality of your financial planning input data.

But improve it you must because the quality of your input data significantly affects the quality of the output you achieve: “garbage in, garbage out”.

The best in class companies are much less likely to base forecasts on a combination of historical data, current performance and forward indicators.

This helps these companies to shift the focus from looking back to looking at the road in front.

6. Keep your eyes on profit

With this all said, it’s important to not get so attached to a forecast that it becomes your most important consideration. This blinkered approach to financial planning can lead to serious flaws.

The best in class companies know that accuracy must be balanced with the need to improve or preserve profitability.

They know that while forecast accuracy is very important, it cannot be to the detriment of good business decisions.

In other words, the best performing companies focus on the overall health and profitability of their business, rather than managing rigorously to achieve a forecast.

Forecast deviation is serious (and a potentially grave threat to profitability), but they have a wider view of the financial planning process.

7. Modernise your processes with smart use of technology

There are three key areas where the use of technology can help you improve your current financial planning performance. And these are three areas that successful companies focus their attention on.

Firstly, best in class companies ensure that their people involved in forecasting processes are automatically guided through steps with smart systems.

Secondly, they ensure that events outside of the company (e.g. industry or financial changes/events) trigger an alert to make a forecast adjustment.

And finally, and most importantly, they use technology to automatically link internal events to financial planning activity. When a contract fluctuates, or a schedule is missed or an order lost or whatever event it is, they automatically trigger an alert to adjust the forecast.

Just imagine the advantage this gives you not only in forecast accuracy but also in removing unnecessary layers of manual data handling.

So what are the next steps to improve your financial forecasting performance?

Here is a quick recap on what highly effective habits you can learn from the best:

- Establish enterprise wide forecast collaboration from the top-down and bottom up as well as across departments

- Produce timely forecasts

- Closely link the achievement of targets and goals to achievement and compensation for all employees

- Develop agility with ‘what if’ scenarios and change analysis before finalising plans

- Improve the quality of your input data to significantly affect outcomes

- Focus on the overall profitability of decisions above the rigid adherence to goals

- Use technology to receive alerts triggered by internal and external events, and be automatically guided through the steps of your forecasting process.

Begin implementing these changes to your forecasting processes and you can’t help but improve outcomes.

Observing, emulating and improving on the activities of successful companies are great ways to drive positive change to your financial planning.

Turn forecasting pain into competitive gain!

As the saying goes, if you keep on doing what you’ve always done, you’ll keep on getting what you’ve always got.

Let us Help

Why not let Access Analytic help you develop highly effective forecasting processes and models?

We can assess your situation, recommend the most appropriate tools, build budgeting & forecasting solutions using these, and consult on best practices.

Simply contact Principal Business Analyst Jeff Robson on +61 8 621 8500 or +61 412 581 486 or leave your details below for a confidential discussion.