AI and the Future of Financial Modelling

Financial Modelers spend most of their lives thinking about the future and imagining different scenarios for their clients.

But what about the future of financial modelling?

Can Artificial Intelligence Replace the Modeler?

There are some modelers who predict that artificial intelligence (AI) and machine learning will eventually become so clever that it will be able to produce a fully-functional financial model plus provide advice and analysis based on this.

Others share a less optimistic view of the abilities of technology, questioning whether a computer will be able to read a business plan, understand it, ask additional clarifying questions, translate all of this into a financial model that accurately represents the variables and their interrelationships, then produce scenarios and meaningful analysis.

Current AI and machine learning techniques have been quite successful in producing very clever predictive models when there’s a large amount of historical data to train and build the models. AI has also been successful in developing prescriptive models where it analyzes many potential outcomes and finds the optimal solution.

However, can a computer produce the kind of driver-based three-way financial model that modelers regularly produce, with multiple inputs, outputs and an analysis of the results under different scenarios, for both short and long-term timeframes with varying levels of detail and complexity?

Yet, unlike fossil fuels, data isn’t depleted when you use it and has a miniscule environmental footprint.

In fact, knowledge derived from data has enabled us to develop clean, renewable energy sources, which are inexhaustible and significantly healthier for us all.

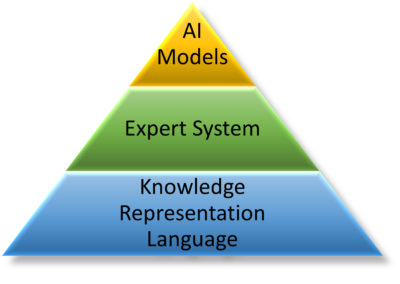

The Foundation is Currently Missing

The first step towards greater AI involvement in financial modelling is to develop a language that can be used to describe financial modelling problems in a systematic way that a computer can understand and a human can verify.

To build a language that represents the knowledge and skill contained in financial modelers’ heads, and has sufficient flexibility and robustness to allow for all the different permutations, functionalities and flexibilities required in financial modelling is undoubtedly a difficult process that has not been achieved to date.

Only a few years ago, tasks such as this would have seemed impossible, but who would have thought AI could diagnose patients, drive a car, or recognize faces in photos!

What is unachievable today might be achievable tomorrow.

If this occurs, AI-based financial modelling could be developed in a similar way to other expert systems that ask a series of intelligent, structured questions, then produce their results.

Building on the Foundation

If the foundation was in place, some of the AI-based financial modelling solutions we might see could include the following:

Goodbye Spreadsheet Drudgery

As a first step, financial modelling process automation is already available to assist the financial modeler to develop their models much faster. Rather than the modeler constructing all the various formulas required for a financial model, software does the bulk of this work.

Software such as Modano, automates the creation and maintenance of the basic model framework, allowing the modeler to focus on customizing the model and other value-added activities.

As these systems develop, they could evolve from process automation into AI-based financial modelling, where the AI “understands” what it is modelling and provides suggestions, asks clarifying questions, and interprets the results based on its knowledge of previous models.

When aided by AI, the modeler becomes even more productive and efficient because the combination of Human + AI is much more powerful than either on its own. AI removing the tediousness of model construction is like when spreadsheets removed the tediousness of having to do hundreds or thousands of manual paper-based calculations.

If this occurs, the financial modeler’s role shifts from an emphasis on constructing financial models to primarily focusing on advising and interpreting these – even more than occurs today.

For relatively simple financial models, an accountant, CFO or other business user may be able to use an AI-based system to produce the models they need without the assistance of a specialist financial modeler, using something like a more intuitive version of Castaway or Invest for Excel.

Evolutionary Models

AI may also be able to create millions of models, then iterate and optimize these to see which ones produce the best results.

It could explore far more options than what a human modeler could consider and may then potentially produce some interesting and useful insights that would not have been discovered otherwise.

Looking even further ahead, the AI model could also be setup to continually absorb new sources of data and thereby provide continuously optimized analysis.

There could well be many other ways AI could assist or automate financial modelling.

What could an AI-based Model look like?

An AI-based financial modelling system need not be restricted to using spreadsheets. It could use another system entirely that is better suited to modeling and is more easily generated by the expert system. Of course, basing it on another platform is likely to cause significant resistance with existing modelers as virtually every financial modeler currently uses spreadsheets.

Regardless of the platform, the model produced would still need to be transparent and auditable so someone could review it and verify the logic. A “black box” approach is unlikely to be successful because the user may wish to understand how the results are obtained.

Conclusions

We are probably still some way off developing a suitably structured language for describing financial modelling problems, and even further away from building an AI-based financial modelling expert system using this language.

However, if (or when?) these are developed and become widespread, financial models are likely to change significantly. Existing financial modelling process automation systems may form the foundation for these.

The future financial modeler will need to have even greater skills in business analysis and advice, but perhaps there will be less requirement for them to possess a comprehensive knowledge of Excel formulas.

Financial modelers today should embrace AI as it has the potential to make them more productive and to make the financial models they produce more reliable, more valuable and better-structured.

Like financial models, there are many potential future scenarios!

Further Reading

- Expert Systems

- On Conceptual Modeling: Perspectives from Artificial Intelligence

- Castaway Forecasting Software

- Modano Financial Modeling

- Invest for Excel

- What is Prescriptive Analytics

Contributions gratefully received from Lance Rubin (Model Citizn) and Miron Meydan (Parity Analytic)