The Top 10 ways CFOs can do more with less – Part 1

By Jeff Robson

Travelling around to different businesses, it seems that everyone is under pressure to reduce costs and improve productivity.

But how do you do this when everyone is already working really hard? They’re already too busy just getting all their work done to think about ways of improving it.

The solution is to use technology better to generate new ways of improving productivity.

So here is our view of the top 10 ways CFOs, accountants and finance staff can do more with less – part one.

1. Budgeting and Forecasting

Problem: Budgeting and forecasting is vital – everyone depends on accurate forecasts to manage costs. But this activity also consumes huge amounts of time. Often, this is because so many people need to be involved, the technology used is cumbersome and the processes are complicated.

Because it consumes so many resources, it’s done less frequently, and that means it’s not the dynamic, timely decision-making tool that managers really need to respond quickly to changing internal and external conditions.

Furthermore, many companies only forecast the Profit and Loss without recognising the impact on cash flow or balance sheet. This produces a very distorted view which often leads to poor decisions.

Solution: Specialist budgeting and forecasting systems have become much more affordable for smaller and mid-sized companies so more companies are now using them.

They make it far easier, faster, simpler and more secure to:

- Produce the budget

- Coordinate those involved

- Produce multiple scenarios

- Redo forecasts

When you can forecast easily with far fewer resources, companies often forecast much more frequently, thereby providing management with more timely, accurate and reliable information for improved decision-making.

Even if a new system isn’t warranted, carefully review your existing budget processes and highlight the inefficiencies. Many can be eliminated through relatively small changes.

2. Board and Management Packs

Problem: There are often many laborious, manual, error-prone processes to gather, collate and analyse the data required to generate Board and management reports.

The more people, manual processes and complexity, the more wasted resources and the higher the risk to the business of fraud and/or error.

Business Analysts often spend more time collating and manipulating data than analysing it, wasting the organisation’s time and money.

Solution: Automating reporting to collect, extract and present required information provides huge productivity gains, reduces the risk of fraud/error, and provides more timely and accurate information for decision-making.

By using a centralised source of data, rather than copies in a spreadsheet, everyone in the organisation sees the same version, thereby improving decision-making further and reducing arguments.

Improving access to and usage of data often provides surprising and valuable insights into opportunities to improve, optimise, cross-sell, reduce costs, improve productivity, eliminate waste, standardise and extend benefits from one part of the business to other areas.

Depending on your requirements, Excel may satisfy your needs or you may wish to examine other reporting tools.

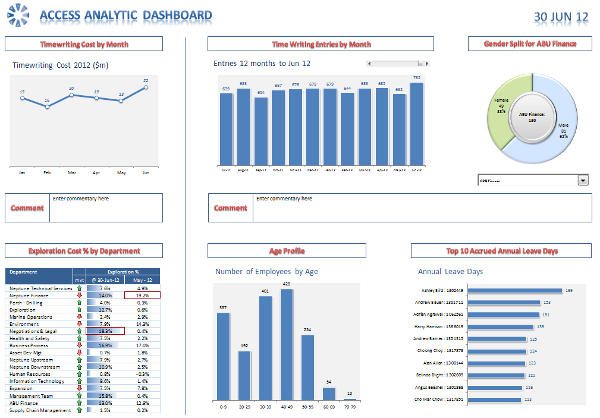

3. KPIs, Dashboards, and Scorecards

Problem: If these aren’t linked to corporate strategy, aren’t well-understood, or measure too many things, management focus will often shift to things that aren’t actually important. This wastes time preparing and analysing irrelevant information, plus it confuses decision-making.

Solution: Simplify the number and presentation of KPIs so that only the most important are retained for each person. This will:

- Reduce the preparation workload

- Focus everyone on the things that are most important

- Provide clarity about goals and the strategies to achieve them

You can also utilise technology to extract the information from its source and automatically present a summarised view that has access to detail where required. This can also incorporate user-friendly ad hoc query tools that end-users can understand so they can answer their own questions and analyse data themselves.

These tools used to be cost-prohibitive, but in recent years, they’ve become much more affordable for small and mid-size companies. Microsoft have also been very busy building these capabilities into Excel so, depending on your requirements, you may not even need any additional software.

4. Financial Modelling

Problem: Finance staff often lack the training to produce accurate models and scenarios quickly and efficiently. Consequently, decision-makers, banks and investors either can’t see accurate information about the impacts of potential decisions, or the models presented haven’t been assured and so the analyses are often flawed.

Solution: Don’t struggle with financial modelling if it’s not your area of expertise. Outsourcing to expert professionals is often more efficient and achieves vastly superior results.

However, if you prefer to continue undertaking financial modelling in-house, ensure models are audited by a competent, independent reviewer to ensure their integrity and reliability.

5. End of Month Processes

Problem: Similar to other regular reporting such as KPIs, dashboards, and Board / management packs, end-of-month accounting typically involves many manual processes, duplication and improper use of available systems.

Solution: Review your processes and software capabilities. It’s often surprising how things just go on and on, staying the same, despite laborious inefficiencies. Staff just keep following the same old manual, time-consuming and error-prone processes each month because they don’t know what Excel and their other existing systems can do.

The improvements that are possible are often truly amazing.

Commit time and resources to becoming more efficient – investments in this area quickly deliver payback in months, not years!

We commonly reduce process time by a staggering 90 to 95% by restructuring spreadsheets, improving processes, and introducing integration and automation. Imagine what this could mean in your organisation!

The Top 10 ways CFOs can do more with less – Part 2

If you’d like to explore how we can help your business do more with less, contact us today on +61 8 6210 8500 or +61 412 581 486 or leave your details below for a confidential discussion.