How ChatGPT’s Premium Features are Revolutionising Financial Modelling

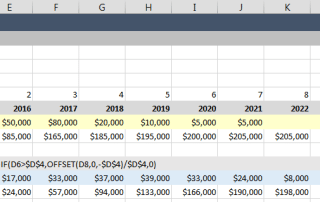

How ChatGPT’s Premium Features are Revolutionising Financial Modelling Financial modelling has long been a mainstay of the financial industry, essential for everything from risk assessment to capital allocation. Generative Artificial Intelligence (AI) technologies, like ChatGPT, are fundamentally changing financial modelling processes. At the risk of sounding like an advertisement for ChatGPT, the premium features (e.g. [...]