Yury Tokarev is a highly accomplished finance professional and international trainer with over 25 years of experience in financial modelling and advanced analytics. As a Director at Access Analytic, Yury specialises in leveraging data-driven insights to enhance strategic decision-making through sophisticated analytical tools, including Power BI and AI.

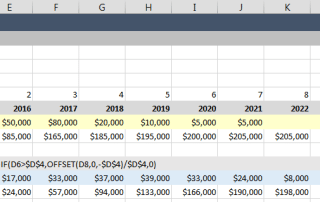

Yury’s extensive background includes developing complex financial models across various industries, automating Excel-based solutions for efficient data management, and designing Power BI reports that integrate a variety of metrics, including financial, people, and ESG indicators. His expertise uniquely positions him to address the evolving needs of senior financial professionals as they embrace digital finance and sustainability initiatives.

Prior to joining Access Analytic, Yury gained significant experience in investment banking, corporate finance, and business services and advisory. These roles provided him with a deep understanding of strategic financial planning, complex financial transactions, and advisory services, which he now leverages to deliver cutting-edge solutions in digital finance transformation and analytics.

As an engaging and interactive trainer, Yury has delivered numerous workshops and training sessions globally, helping professionals elevate their understanding of financial modelling, Power BI, and AI analytics. His teaching approach combines practical insights with real-world applications, empowering participants to effectively apply advanced analytics and AI in their strategic roles.