How to tell if your Financial Models are at Risk

By Jeff Robson

Worldwide, legions of spreadsheets support corporate infrastructure. Every day, directors, managers and professionals in all disciplines use those spreadsheets to make business-critical decisions with far-reaching consequences. But, many studies over the past 10 years have shown that 80 to 90 percent of significant spreadsheets contain errors. A quick web search will turn up hundreds of high profile spreadsheet blunders that have had consequences in the millions and even billions of dollars.

Access Analytic’s own recent spreadsheet audits have unearthed many errors over the years. The largest was an $800m error in a Government tender spreadsheet.

And no one’s immune. In 2010, even the Federal Reserve – the USA’s central bank – made a blatant spreadsheet data error which had a $4 billion impact on a monthly Consumer Credit figure.

When the Town of Framingham in the United States mistakenly reckoned it had $1.5 million more in its 2011 budget than it actually had, its Chief Financial Officer said; “A figure went missing as staff managed ‘monstrous spreadsheets’.

The Top 5 Spreadsheet Risks

According to the European Spreadsheet Risks Interest Group – EuSpRIG – the top 5 risks are:

- Human Error – To err is human, hence more than 90 per cent of large spreadsheets contain some level of error. Because spreadsheets are rarely tested, these errors often remain undetected for years!

- Fraud – Because of the ease with which program code and data is mixed, spreadsheets are open to fraudulent manipulation.

- Overconfidence – Spreadsheet users almost universally believe that errors only occur in “other people’s spreadsheets”. As a result, they never go looking for errors in their models, so they never find any. This feeds their overconfidence and so the cycle continues.

- Interpretation – Translation of a business problem into a spreadsheet can result in decision-makers acting in the belief that decisions can be made with confidence in the spreadsheet outputs – when often, they simply can’t.

- Archiving – Poor archiving can lead to weaknesses in spreadsheet control that contribute to operational risk.

Is Your Financial Modelling at Risk?

In Access Analytic’s experience, you’re at risk of trusting unreliable financial models if these Key Risk Factors for your Spreadsheets exist:

- The results will be used by many people.

- The spreadsheet has existed for a long period of time.

- Its outputs will be relied upon by senior management and or investors.

- It has been modified by more than one person.

- It is used for legal compliance or has a financial impact.

- The results published externally.

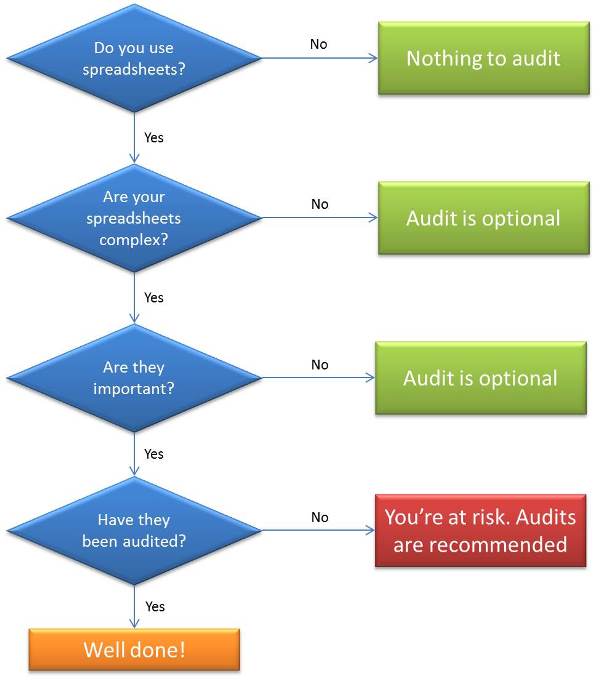

Do I need to Audit our Spreadsheets?

If you haven’t taken appropriate steps to ensure that your spreadsheet models are giving you accurate results, you’re exposed to a huge risk!

Mitigating the Risk

The most effective way of mitigating this risk is with an independent spreadsheet audit.

Your spreadsheet auditor will usually start by developing a good understanding of the model: how it’s structured, where the information comes from, how it flows through the model, key model components, and how the underlying project or business works.

The auditor will usually employ specialised spreadsheet auditing software together with techniques that are designed to thoroughly review the model as quickly and efficiently as possible.

Ideally, they’ll also have a lot of experience in doing spreadsheet audits plus they’ll have a broad range of relevant skills (e.g. accounting, finance, auditing, and often specialised industry knowledge).

At the end, you’ll usually receive a draft audit report (similar to a company’s financial statements audit report) together with a detailed list of findings.

If there are any changes to be made to the model, you can choose to make these yourself then get the auditor to review them, or, the auditor may assist you in making changes to your model (although they must remain independent so may engage another consultant to review their work).

Next Steps Towards Trusting Your Spreadsheets

If you’re looking for a highly-experienced spreadsheet auditor who can provide an independent review of your spreadsheets, contact Jeff Robson, Certified Information Systems Auditor, Excel Expert, and Principal Business Analyst at Access Analytic. Call +61 8 6210 8500 or e-mail jrobson@accessanalytic.com.au

We can arrange a confidential discussion of your business-critical financial models and then provide a fixed-price proposal for your review.