by Jeff Robson

Fixed vs Variable Loan Products … which is best?

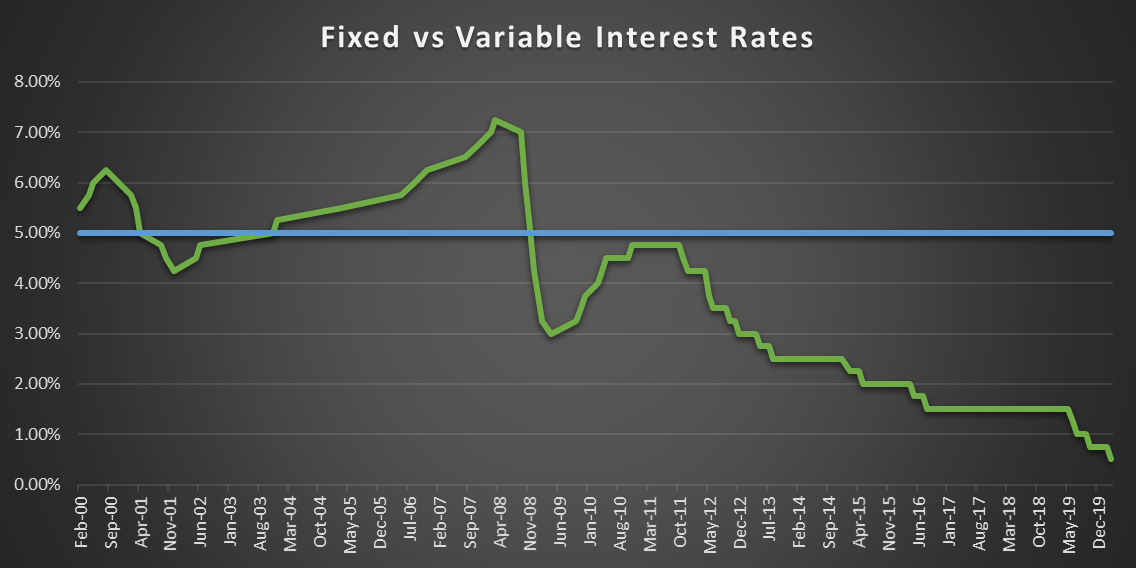

It can be difficult to compare fixed vs variable loan products.

Banks often market loans with fixed interest rates using the selling point of certainty: “you’ll always know what your repayments will be”.

Check the fine print!

While certainty can be somewhat attractive, there’s a price to pay!

Fixed interest rate loans usually carry a significantly higher rate & usually have break fees that apply if you want to repay the loan early.

This means you’re exchanging flexibility for certainty because most variable rate loans have useful features such as:

- A 100% offset savings account

- The ability to redraw surplus funds

- The ability to pay the loan off sooner by increasing your repayments

Are Fixed Rate Loans Really Worth it?

Banks have teams of specialist experts forecasting the interest rate movements so they’re highly unlikely to lose when providing fixed interest rate loans. That means you’re highly unlikely to come out ahead!

Before you take out a fixed-rate loan, use our free calculator to compare your options.

You can input what you think might happen with interest rates in future and calculate the total amount of interest you’ll pay under both types of loans.

You can then estimate which will be better for you and make an informed decision.

How it works

The calculator uses dynamic array formulas to create a loan schedule based on your inputs.

Important: the calculator requires the use of iterative calculations to avoid circular references so if you get a warning about the file containing circular references, please ensure this is enabled before you use the model (see the Intructions sheet for details).

Take a look at the formulas to see some interesting examples of how to apply dynamic array formulas to situations like this. If you have any additional questions, just get in touch.

Pre-requisites

- Office 365 with dynamic array formulas

Read more: Loan Structure – Understanding Fixed & Variable Interest Rates

Note: Access Analytic Solutions Pty Ltd is not a financial adviser. Please seek advice from a professional financial adviser before making any decisions about financial products.